Difference between revisions of "Wisconsin- WI"

Jump to navigation

Jump to search

| Line 8: | Line 8: | ||

*Wisconsin Works | *Wisconsin Works | ||

*WI Homestead Property Tax Credit | *WI Homestead Property Tax Credit | ||

| + | |||

| + | '''Eligibility Programs Contained in the State-Maintained Eligibility Database''' | ||

| + | |||

| + | *SNAP | ||

| + | *SSI | ||

| + | *Medicaid | ||

| + | *TANF | ||

| + | *Badger Care | ||

| + | *LIHEAP | ||

| + | *Wisconsin Works (W2) | ||

| + | |||

See [[General Rules]] for more information. | See [[General Rules]] for more information. | ||

Revision as of 14:52, 29 October 2014

Contents

Acceptable Subsidies

The standard eligibility programs that may be used as proof of subsidy include Temporary Assistance to Needy Families (TANF), Supplemental Security Income (SSI), Food Stamps, Medicaid, National Free School Lunch Program, Federal Public Housing Assistance (FPHA), and Low-Income Home Energy Assistance Program (LIHEAP).

State-Specific Eligibility Programs

- Badger Care

- Wisconsin Works

- WI Homestead Property Tax Credit

Eligibility Programs Contained in the State-Maintained Eligibility Database

- SNAP

- SSI

- Medicaid

- TANF

- Badger Care

- LIHEAP

- Wisconsin Works (W2)

See General Rules for more information.

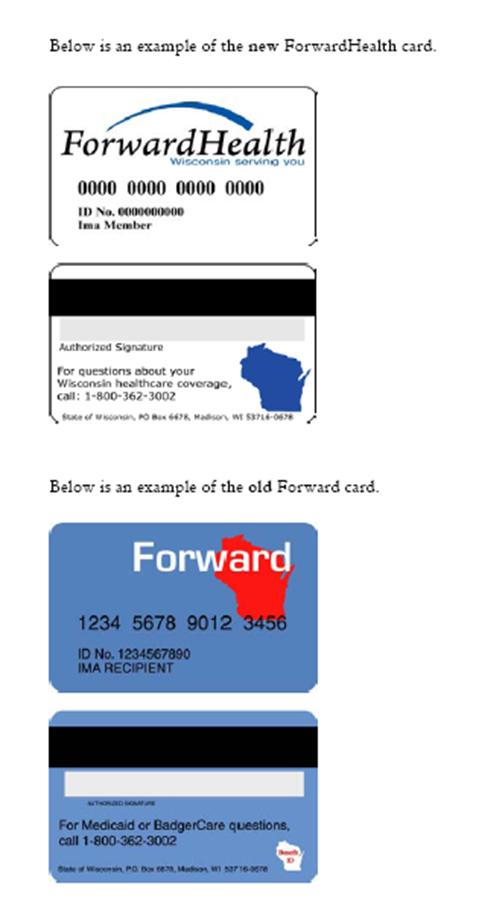

Acceptable Subsidy Proof Examples

Food Stamps Award Letter (Spanish)

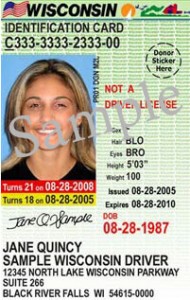

Acceptable ID Examples