Difference between revisions of "Oklahoma - OK"

Jump to navigation

Jump to search

| Line 30: | Line 30: | ||

'''Oklahoma Sales Tax Relief''' | '''Oklahoma Sales Tax Relief''' | ||

| − | [[Image:Ok-sales.gif]] | + | [[Image:Ok-sales.gif]][[Image:Ok-sales_tax_exempt.gif]] |

'''Food Distribution Program on Indian Reservations (FDPIR)''' | '''Food Distribution Program on Indian Reservations (FDPIR)''' | ||

Revision as of 11:24, 18 June 2014

Contents

Acceptable Subsidies

The standard eligibility programs that may be used as proof of subsidy include Temporary Assistance to Needy Families (TANF), Supplemental Security Income (SSI), Food Stamps, Medicaid, National Free School Lunch Program, Federal Public Housing Assistance (FPHA), and Low-Income Home Energy Assistance Program (LIHEAP).

State-Specific Eligibility Programs

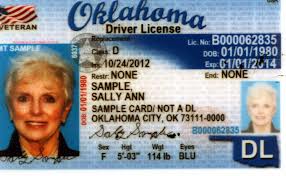

- Oklahoma Sales Tax Relief

- Vocational Rehabilitation (including aid to hearing impaired)

State-Specific Tribal Eligibility Programs

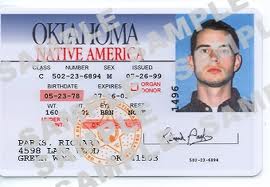

- Food Distribution Program on Indian Reservations (FDPIR)

- Bureau of Indian Affairs General Assistance (BIA)

- Tribally Administered TANF (TTANF)

- Head Start (meeting income qualifying standards)

See General Rules for more information.

Acceptable Subsidy Proof Examples

Food Distribution Program on Indian Reservations (FDPIR)

Food Distribution Program on Indian Reservations Benefits Tracker